Curve Review: Is It the Solution to Combining All Your Cards?

When you review as many cards as I have, the ever-growing mountain of plastic starts to bother you over time. Although it may not be for the same reasons, I’m sure I’m not the only one with multiple cards. So, when you already have a few, it’s not hard to see yourself outgrowing your wallet or purse down the line.

If you recognise yourself in the above description, there’s some good news for you. One company has made it their business to tackle this problem: Curve.

But just how effective is Curve at tackling the issue? The answer to this question and more can be found in this Curve review I created today. Let’s dive in.

What Is a Curve Card?

Curve is a budgeting app and Mastercard debit card that allows you to connect all your existing cards in one place so you can spend from one single card.

The Curve Card was created by serial entrepreneur Shachar Bialick in 2015 to devise a simpler and smarter way to manage your financial life. Curve released its beta version in 2016 and made improvements until its final version in 2018. It was introduced in Ireland and then released in the UK shortly after.

How Does the Curve Card Work?

Like many of the ‘new school’ banks/cards I’ve reviewed in the past, Curve works via an app. That means you can perform most actions at the touch of a button, which is very handy. Curve doesn’t provide the typical features of any other traditional bank/card because it doesn’t need to. Functions such as direct debits and standing orders can all be set up through your linked bank accounts.

Features

(Note: All of these features come as standard and don’t require an upgraded plan)

Next up is perhaps the most interesting part of this Curve review. Aside from its primary feature of connecting multiple cards, ‘new school’ companies like Curve provide various tools to compete against other cards.

These tools give you more control over your finances in general and help you develop your money management skills, among other things. Let’s take a closer look at each one in more detail next in this Curve review, and you’ll understand what I mean.

Overseas

Curve is great for use overseas because there are no transaction fees for the Curve Card or any other card you use through Curve. This even applies to cards that would otherwise have a fee. How cool is that? It’s fair to say that you’ll have no trouble with this card overseas, and you should definitely take advantage of it when on holiday.

Instant Notifications

You can get real-time notifications on your phone whenever you use your Curve Card. As you can imagine, this is handy for a whole host of reasons, including money management and identifying fraud. It’s a simple but useful feature that even traditional banks haven’t adopted yet.

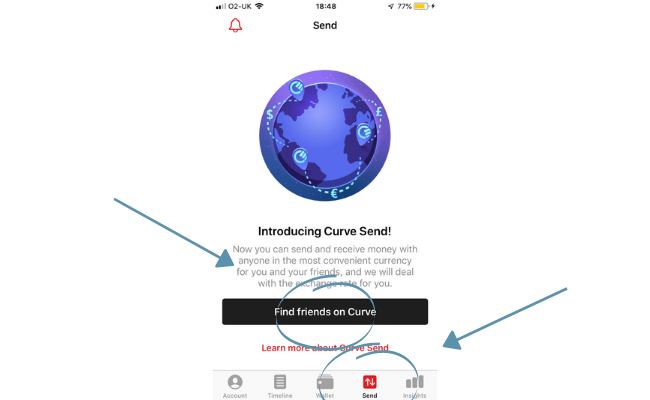

Curve Send lets you easily send money to your friends and family using any of your payment cards linked to your account. You can send up to £500 a day in any currency, and Curve will take care of any FX charges you may incur (the Curve Blue card is limited to £500).

But you should be aware that money can only be sent to another Curve cardholder.

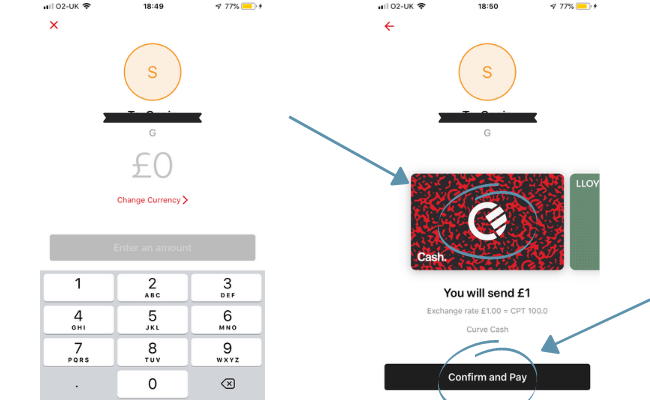

To use Curve Send, simply head over to the ‘send’ section on the dashboard.

Choose a contact and a title (e.g., electricity bill). Then, enter the amount you want to send, choose the card, and send it. Easy as that.

Cashback

With Curve, you can earn 1% cashback from a number of retailers like Tesco, ASOS, and Uber. Curve also promises to give you 1% cashback on top of the card you’re using through them. Restrictions do apply, and you can find more information about these restrictions under the ‘Card Versions’ section.

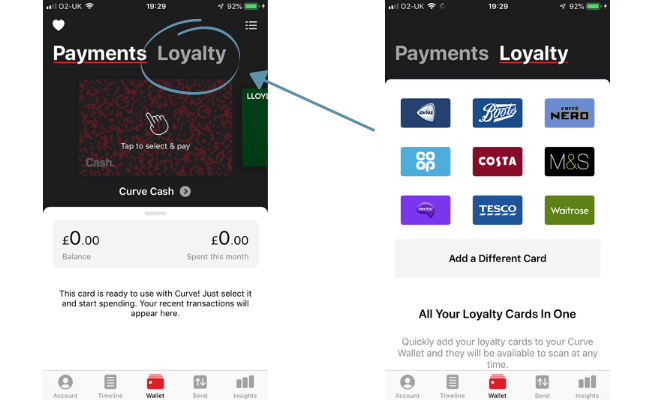

Loyalty Cards

Just when you thought Curve couldn’t get any more in-house, you now also have the option to link your loyalty cards to Curve. This allows you to use them anytime, just like your other cards. Currently, Curve can integrate cards from Tesco, Costa, Boots, and more. To do this, switch over to the loyalty option on the main screen and add a card of your choice.

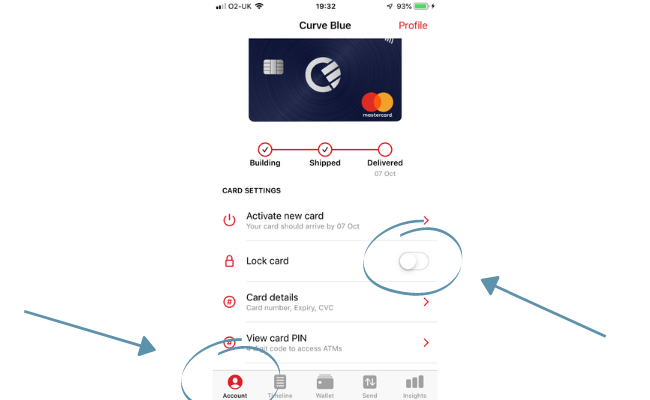

Lock Your Card

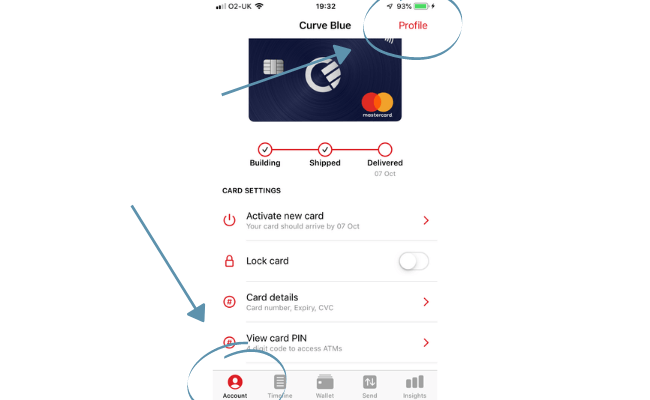

If you ever lose or misplace your card, you can easily lock it using the Curve app. Just go to the ‘account’ section and slide the toggle.

This feature saves you from lengthy and tedious phone conversations with your card provider.

Back in Time

The Curve app allows you to go ‘back in time’ and switch the card you used for a purchase within the past two weeks (up to £1,000). This exclusive feature solves the problem of using the wrong card for payments.

Categorisation

Similar to other challenger cards, Curve offers a categorisation option for your money. This gives you more financial freedom and promotes better management. Unlike challenger banks like Monzo that use a pot system, Curve categorises your money using different colours.

Pay Bills

You can pay UK taxes and credit card bills using another card by enabling Curve Fronted. Blue and Black Curve cardholders are subject to a 2.5% fee on the total transaction value when using Curve Fronted.

To activate this feature, scroll down to ‘profile’ and find ‘Curve Fronted’.

Spending Timeline

The Curve interface displays your spending timeline, showing the ins and outs of your account each day. It provides a clean and clear overview of your Curve account activity.

Contactless Functionality

In today’s market, this is considered a standard feature, but it’s always useful to know. The increase in the contactless limit (£45 in the UK) means you can buy more without needing a PIN—an important feature during the pandemic.

Is Curve Safe?

The Financial Conduct Authority (FCA) regulates the Curve through a representative firm.

The goals of the FCA are to:

- Safeguard customers

- Enhance the integrity of the UK financial system

- Promote healthy competition to improve public service.

That means your details and private information are safe and secure.

Unlike most cards/banks, Curve is not protected by the Financial Services Compensation Scheme (FSCS).

The scheme is designed to protect customers’ money (up to £85,000) if, for any reason, the company were to go bust.

Curve is not eligible because your Curve balance is classified as e-money, which doesn’t fit the criteria for protection.

However, it should be noted that Curve’s balance is kept separate from the customer’s funds—this is known as safeguarding.

(Note: Curve is not protected by section 75 of the Consumer Credit Act)

Curve Card Versions

Similar to Revolut, Curve offers three different cards.

Here’s a breakdown of what’s included in each one so you can determine which one suits you best.

| Curve Blue | Curve Black | Curve Metal | |

|---|---|---|---|

| Cost | Free | £9.99/Month | 14.99/Month |

| FX rates | £500/Month | Unlimited | Unlimited |

| Overseas Spending | £200/Month | £400/Month | £600/Month |

| Cashback | 1% - 3 retailers for 90 days | 1% - 3 retailers for unlimited time | 1% - 6 retailers for unlimited time |

| Contactless Functionailty | Included | Included | Included |

| Curve Protection | Upto £100,000 | Upto £100,000 | Upto £100,000 |

| Insurance | N/A | Travel Insurance Included | Travel, phone and rental car insurance included |

| Spending Limits | £200 withdrawal/Day, £2000/Day, £500/Month & 10,000/Year * | £1,000 withdrawal/Day, £3,750/Day, £20,000/Month & £50,00/Year | £1,000 withdrawal/Day, £3,750/Day, £20,000/Month & £50,00/Year |

| Subscription period | 0 | 0 | Minimum of 6 months |

*Regarding blue cardholders, you may be subject to lower limits initially depending on certain criteria.

As you can see, there is quite a difference between the perks of each card.

Ultimately, it would be your decision, but I hope this side-by-side comparison makes analysing their perks easier.

Curve Card Reviews

As with all my reviews, I like to include other opinions or experiences to arrive at a more well-rounded conclusion.

On Trustpilot, Curve has an overall rating of 3.9 out of 5 from over 8,000+ reviews.

68% of those Curve reviews rated them as excellent, while 14% rated them as bad.

Users’ positive reviews of Curve include:

- Easy to use

- Makes life easier

- Good cashback options.

The negative Curve reviews mention things such as:

- Questionable customer service

- Failed transactions.

FAQs

How Do You Cancel Your Curve Card?

To cancel your Curve account, you’ll need to contact Curve directly and provide the reason for cancellation.

How Long Does It Take to Get a Curve Card?

After you’ve signed up, it should take a few days to arrive via the post.

Is Curve Safe to Use?

Yes, Curve is safe to use as the FCA regulates them through an appointed representative.

What Is the Company Curve?

Curve connects your bank accounts to allow you to spend money all via your one Curve Card.

What Is Curve Wallet?

Curve allows you to spend money from your different cards via your Curve Card, eliminating the need for a wallet.

How Much Do You Have to Pay for Curve?

Curve is free, but they do have monthly subscription cards with more features/perks.

Can You Withdraw Curve Cash?

No – Curve cash is not redeemable for actual cash, so you cannot withdraw it.

Final Thoughts on Curve

Now that this Curve review is coming to an end, I hope you have gained a better understanding of the products and services they provide. It is undeniable that the overall concept of Curve is simple yet ingenious, and this sentiment is shared by all customers, regardless of their experience.

Curve does its best to solve a growing problem (literally) and deserves recognition.

Having said that, innovative ideas are great, but the execution is what truly sets successful companies apart from the rest.

In my opinion, Curve is almost there – it just needs some optimisation of its features.

If it were me, I would consider getting another primary card alongside my Curve Card, just to be safe in case of any transaction issues.

Whether or not you believe this defeats the purpose of having Curve will ultimately determine if it’s the right choice for you.

I hope you enjoyed this Curve review as much as I enjoyed researching it for you.